HOW TO APPLY FOR A REBATE

Have you already purchased or leased an eligible vehicle? If so, you can start your application by clicking the “Apply” button below to create a program account. You’ll then have access to a dashboard where you can start new applications, adjust existing applications, and check the status of submitted applications.

To be eligible, your application must be successfully submitted within 180 days of the date you purchase or lease your vehicle. Your application will be considered submitted once the form is complete, all supporting documents are uploaded, and you receive an email confirmation with an assigned Application ID.

For more details about required supporting documents, review the below section “Required Applicant Documents” and refer to our Sample Supporting Documents PDF.

SCE Service Account Number

When you complete your rebate application, please include your current SCE service account number, which starts with the number “8” followed by nine digits in this format: 80XXXXXXXX (in April of 2021, all SCE service account numbers were updated; those starting with 3, 2, or 7 will not be accepted in place of your current service account number beginning with 8). You will find your service account number on a recent SCE bill, and online at sce.com/myaccount.

If we cannot confirm the service account number you entered is correct and active by the time your application is formally reviewed, we may request a copy of one of your recent SCE bills. An applicant must have active service at the time they submit their application or at the time an application is undergoing review to be eligible for a rebate.

Required Application Documents

Applicants are required to submit the following documents. To expedite your application process, be sure to upload legible copies or images in one of these accepted file formats: PDF, JPG, JPEG, PNG, DOC or DOCX. If any of your documents have multiple pages, please combine them into a single file prior to uploading.

Please note, your application is considered submitted once all supporting documentation is successfully uploaded and you receive an email confirmation.

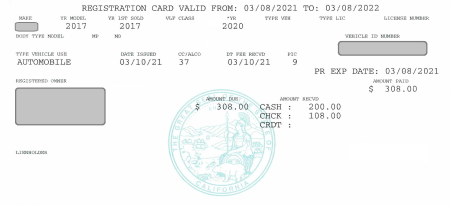

Proof of Vehicle Registration

After you submit your application, you'll upload an image of your valid vehicle registration card or temporary registration showing your current residential SCE service address. If there are two names on your vehicle registration card, choose one vehicle owner or lessee to apply for the rebate (only one owner or lessee, as applicable, may receive the rebate for a particular EV).

Driver License

A copy of the applicant’s current (not expired) California driver license should be submitted as proof of residency. Please make sure all edges of the license are visible and all text is legible in your photo or scan.

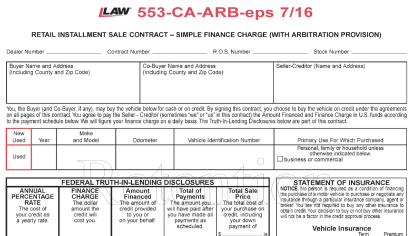

Vehicle Purchase or Lease Agreement

This is the legally-binding contract signed at the dealership before you took delivery of your vehicle. It stipulates the terms of purchase or lease, and may be on carbon paper or a digital copy. All pages of the purchase or lease agreement are required.

If your vehicle was purchased from an individual in a private-party sale, you must submit a copy of your Certificate of Title (pink slip) in place of an agreement. If the vehicle was purchased from an individual in a private-party sale, but a bank or credit union holds the Certificate of Title, you must submit an Electronic Lien and Title document and your signed loan agreement.

If applying for Rebate Plus

If you’re applying for the Rebate Plus option, depending on which eligibility scenario you choose to confirm you meet specific income-based requirements, you must also upload some of the following additional documents with your application:

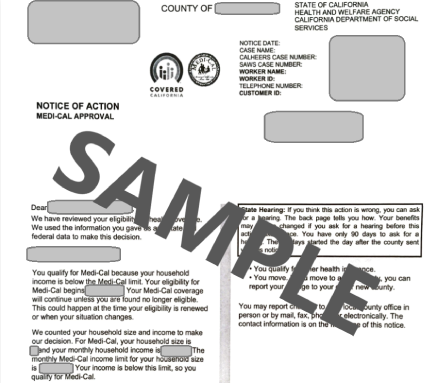

Public Assistance Program Document

This is a form demonstrating proof of enrollment in an approved Public Assistance Program at the time you purchased or leased your vehicle – for example, an Award Letter or Notice of Action. The applicant’s name must match the name of the participant enrolled in the eligible public assistance program (this document is only required if you are verifying eligibility through enrollment in a public assistance program).

You may find a list of eligible public assistance programs here.

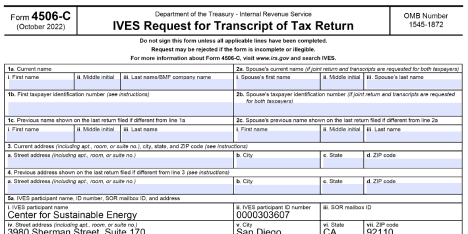

IRS Form 4506-C

This form allows the SCE authorized implementer (Center for Sustainable Energy) to obtain a copy of your tax transcript as income verification. A 4506-C form must be submitted for each person 18 years or older included in your tax return for the year in which your vehicle was purchased or leased. If, at the time you complete your application, the IRS has not yet required you to file your taxes for that year, enter information from the previous tax year on your form instead (this document is only required if you are verifying eligibility through the program income limits, and it will be provided for you to fill out during the application process).

You may find a copy of the IRS Form 4506-C for the 2024 tax return year here.

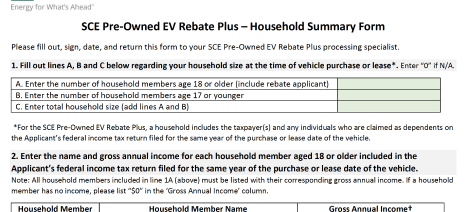

Household Income Summary Form

This form is used to determine your household size and household income at the time you purchased or leased your vehicle. Your household size is made up of the household members listed on your most recently filed tax return, including any spouse or dependents of any age (this document is only required if you are verifying eligibility through the program income limits, and will be provided for you to fill out during the application process).

You may find a copy of the SCE POEV Household Summary Form here.

For more information on the Rebate Plus option requirements, please visit our Program Requirements page, Frequently-Asked Questions, and SCE Pre-Owned EV Rebate Terms and Conditions.