HOW TO APPLY

Customers must apply and be approved for the SCE Pre-Owned EV Rebate before a claim can be submitted.

We strongly recommend you get pre-approved to reserve your rebate funds, even if you haven’t made a purchase or lease decision yet. The pre-approval step is required to submit a rebate claim. Pre-approvals are valid for 60 days.

If you have already purchased or leased an eligible vehicle, you can still qualify for the rebate as long as your claim is submitted within 180 days of the vehicle transaction. Once your application is approved, you can immediately submit your rebate claim.

RESERVE YOUR REBATE FUNDS

Complete the application form and upload all required documents:

Valid California driver's license

A signed copy of the SCE Pre-Owned EV Rebate Customer Terms and Conditions Agreement

A recent SCE billing statement

Additional income qualification documents are required for Rebate Plus applicants

The application process goes faster if you have all the required documents ready to upload.

- Uploaded documents must be in PDF, JPG, JPEG, or PNG format.

- Upload files one at a time.

- If a document has multiple pages, combine them into a single file before uploading.

SUBMIT A REBATE CLAIM

Log into the Customer Dashboard to start new claims and review existing ones.

Click the appropriate Apply button above

- California DMV Registration

- Completed vehicle purchase or lease agreement

- Final Customer Vehicle Purchase/Lease Acknowledgment. For private sales, the customer will need to upload the Vehicle Title in lieu of the Purchase/Lease Agreement.

- Public Assistance Program Document

- Tax Return Transcript

- Household Income Summary Form

REBATE PLUS APPLICANTS

Required Documents: Explained

Customers applying for the Rebate Plus option will need to provide additional documentation, depending on the Eligibility Scenario used:

Public Assistance Program Document: A form proving you were enrolled in one of the approved Public Assistance Programs at the time you purchased or leased your vehicle. The applicant's name must match the name of the participant shown on the program document.

This document is only required if you are verifying eligibility through enrollment in a Public Assistance Program.

A list of eligible Public Assistance Programs is available here.

Tax Return Transcript (Most Recent Year Required): To verify your income, we require a copy of your most recent IRS Tax Return Transcript.

You can download your transcript directly from the IRS website through your Individual Online Account by following the steps below.

- Sign in or create your IRS Individual Online Account

To create a new account, you will need the following (as listed on IRS.gov):

- Social Security Number, date of birth, filing status, and mailing address

- Email address

- Mobile phone number

- A financial account number (credit card, mortgage, home equity loan/line of credit, or auto loan)

- Each applicant and every person age 18 or older listed on the tax return must sign in to their own IRS account to download their transcript.

- After signing in, select:

- "Tax Records"

- Then choose "Tax Return Transcript" for the most recent tax year available

- Make sure you choose the Return Transcript as Account Transcripts are NOT accepted

- Download the transcript PDF for the required year(s).

- Upload the transcript directly to the POEV website.

Note: For security reasons, do not email your tax return transcript.

- To upload your transcript and any remaining documents to your Rebate Plus application, please call program support at (209) 670-0055 to request a secure document upload link.

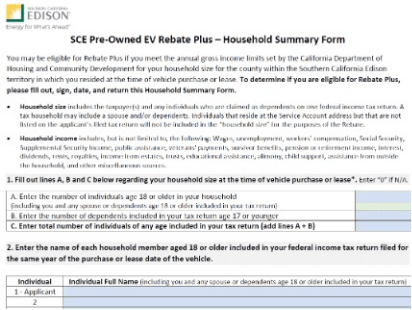

- Household Income Summary Form: This form is used to determine your household size and income at the time you purchased or leased your vehicle. Your household size is made up of the household members listed on your most recently filed tax return, including any spouse or dependents of any age.

This document is only required if you are verifying eligibility based on income. A copy will be provided for you to fill out during the application process.

A copy of the SCE Household Income Summary Form is available here.

For more information about the application process and eligibility requirements, review the Program Eligibility Requirements and Frequently Asked Questions pages, as well as the SCE Pre-Owned EV Rebate Customer Terms and Conditions Agreement.

HAVE QUESTIONS?

Check out the FAQs page for answers to common questions about the SCE Pre-Owned Electric Vehicle Rebate.

View FAQs